Stocks and bonds are fundamentally different types of investments. However, if you are seeking the traditionally very-safe income provided by investment-grade bonds, you’re probably very disappointed by our ongoing “near-zero” interest rate environment. Traditionally speaking, stocks are simply too risky for bond investors. However, not all stocks are created equally, and in this article we review the very-safe yield provided by a specific blue-chip stock (Procter & Gamble) (PG) that has been increasing its dividend for over 6 decades, while its share price has also steadily increased too. Specifically, we review the company’s business, dividend safety, valuation and risks, and then share a conservative income-generating options trade strategy (selling covered calls). We conclude with a few important takeaways (including more blue-chip stock ideas for you to consider).

Procter & Gamble (PG), Yield: 2.3%

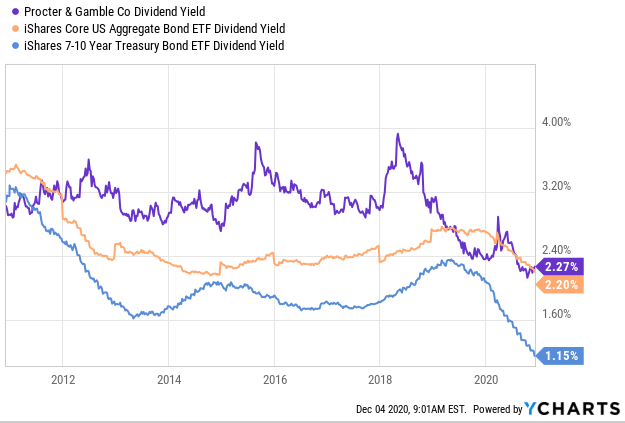

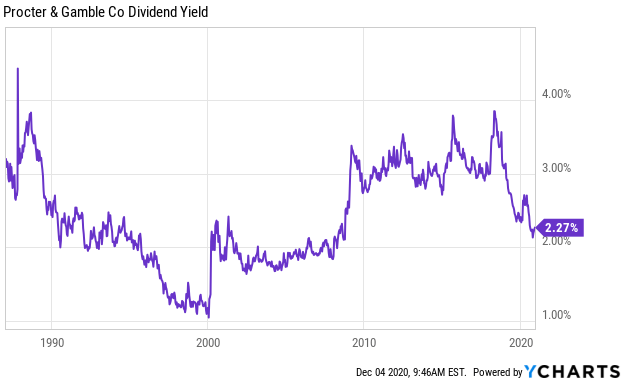

To set the table, let's have a look at the dividend yield of Procter & Gamble versus the Core US Bond market (AGG) and US treasuries (IEF). Notice P&G's dividend yield is only 2.27%, but still the highest of this group.

And very important to note, P&G has increased its dividend for 64 years in a row, and it is highly secure (which increases its attractiveness in our current uncertain macro environment). For example, despite the global pandemic, P&G’s dividend payout ratio is below 60%, leaving plenty of room for continued dividend increases each year. Additionally, PG’s generous share buyback program (~$7-$9 billion for FY21) adds to investor returns.

(image source: Ycharts)

Overview:

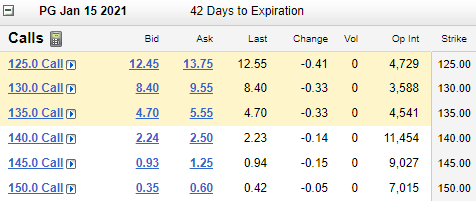

If you don't already know, the Procter & Gamble Company is a global fast-moving consumer goods (FMCG) company which sells branded consumer packaged goods in more than 180 countries. It owns some of the most well renowned consumer brands such as Gillette, Tide, Charmin, Pampers, Head & Shoulders, Oral-B, and many more. PG generated ~$71 billion in revenues in 2020 and $19.3 billion in Q121. It primarily conducts its operations via five business segments.

-

Beauty (~19% of revenue): segment includes hair care and skin & personal care portfolio.

-

Grooming (~9% of revenue): segment includes male and female shaving portfolio. Brands include Gillette, Venus, Braun.

-

HealthCare (~13% of revenue): segment includes oral care and personal health care portfolio.

-

Fabric & Home Care (~33% of revenue): segment includes laundry detergents, fabric enhancers, dish care and others.

-

Baby, Feminine & Family Care (~26% of revenue): segment includes baby wipes, diapers, paper towels, tissues, feminine care portfolio.

source: 10-K Filing

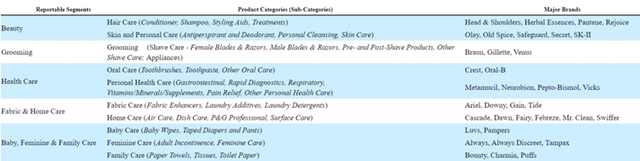

Procter & Gamble has significant competitive advantages given its strong and market leading brands. The business is largely recession proof as the majority of its products fall under "essentials." Also, it’s a highly profitable and cash generative business. P&G’s operating margins and after-tax profit margins are toward the top of its peer group range.

P&G at Top End of Its Peer Group Metrics:

source: Company Presentation

FY 2021 Guidance Raise Reflects Better Market Growth and Cash Flow Prospects

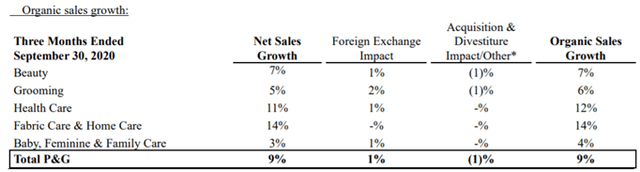

P&G recently reported strong Q1-21 numbers, and also raised its guidance for the full fiscal year 2021. For example, Q1 organic sales grew 9% YOY, the highest quarterly rate in more than a decade. This was driven by growth of premium home, health, and hygiene products. Against a strong Q1, PG is expecting meaningful improvement in top line and bottom line growth for full year FY 2021.

The company also raised its organic sales growth guidance for full fiscal year 2021 to a range of 4% to 5% (earlier 2% - 4%) and core EPS growth guidance to a range of 5% to 8% (earlier 3% - 7%). As earnings improve, free cash flow is likely to increase as well. As a result, P&G expects to a return $15 to $17 billion of cash to shareholders this fiscal year – nearly $8 billion via dividends and ~$7-$9 billion via stock repurchases (these are good things for investors).

P&G’s guidance raise, this early in the fiscal year, reflects confidence on the durability of consumer behavioral changes regarding cleaning and hygiene habits.

source: Company Presentation

Dividends: Safe, Backed by Strong Free Cash Flow

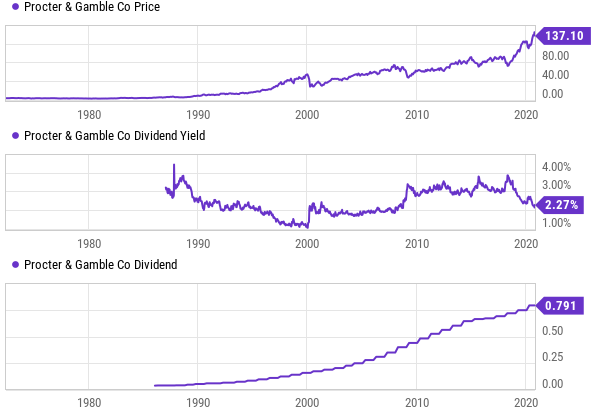

P&G has increased its annual dividend for 64 consecutive years now. The most recent dividend of $0.79 per share results in annualized dividend of $3.16 and a yield of 2.3%. The dividend is backed by solid free cash flow and earnings growth. For example, based on expected fiscal 2021 earnings, P&G has a payout ratio of just below 60%. This leaves more-than-ample room for future dividend increases. In Q1-20 alone, P&G generated free cash flow of ~$4.1 billion, which gives us plenty of confidence that the company will be able to easily meet its full-year goal of a $8 billion in dividend payout. For perspective, management explained the following in its Q1-21 earnings call:

“Fiscal 2021, we'll continue our long track record of significant cash generation and cash returned to shareowners. We're raising our target for adjusted free cash flow productivity from 90% to around 95%. We continue to expect to pay approximately $8 billion in dividends.”

source: Company data

And in addition to the dividend, PG has a history of repurchasing shares which further adds to returns for investors. For fiscal 2021, P&G has increased its outlook for share repurchases to a range of $7 billion to $9 billion (earlier $6 to $8 billion). In combination (dividends plus share repurchases), PG plans to return $15 billion to $17 billion of cash to shareowners this fiscal year.

(image source: Ycharts)

Valuation:

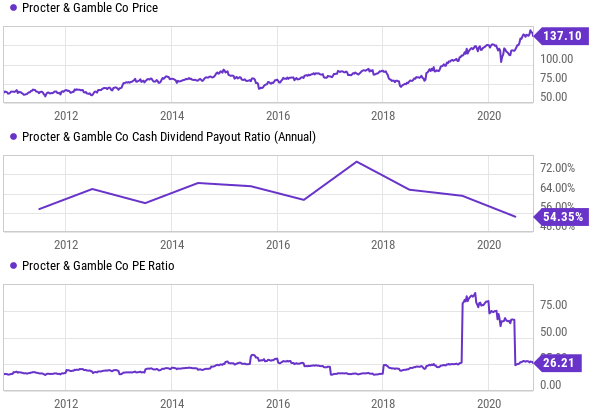

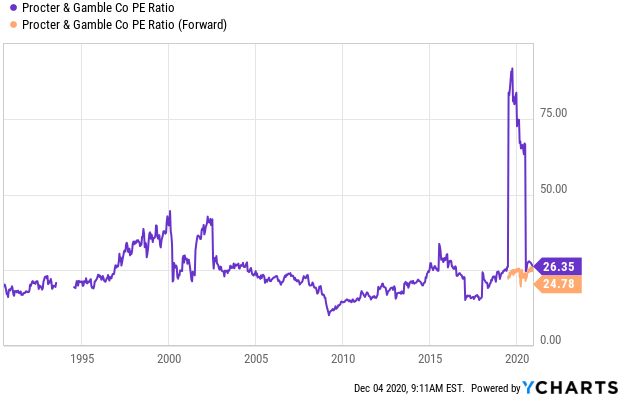

From a valuation standpoint, P&G currently trades at ~24.8x forward earnings (based on its FY 2021 EPS estimate of $5.43). And the current price-to-earnings ratio is ~26.4x. Over the past decade, the median P/E multiple for PG shares has been ~21x. This suggests that the shares may currently be fully valued, and the improved growth prospects for fiscal 2021 also appear to possibly already be priced into the valuation. However, given the low payout ratio, it does leave room for healthy dividend increases, and over the long-term we expect the shares to eventually trend higher and with significantly less beta risk than other stocks (P&G’s 3-year beta was recently ~0.46—well below the market average of 1.0). Furthermore, investors looking for a defensive stock with less volatility risk (particularly if COVID-19 continues on track for a resurgence), could be well served by the capital protection qualities offered by P&G.

Also worth mentioning, P&G's current dividend yield (see chart below) is relatively lower compared to its own history. This is important because management often sends a signal about whether they believe the shares are over- or under-valued based on the dividend yield. Specifically, management sets the dividend payment at a level consistent with where they believe the stock price should trade, in order to keep the yield in the relatively normal range. The fact that the dividend yield is currently a bit on the low side may indicate that management believes its own shares are relatively fully valued in the near term. That's not to say the dividend and the share price won't go higher in the long-term (we absolutely believe they will), but in the short-term, the shares have already delivered strong performance and the P/E ratio is closer to highs than lows.

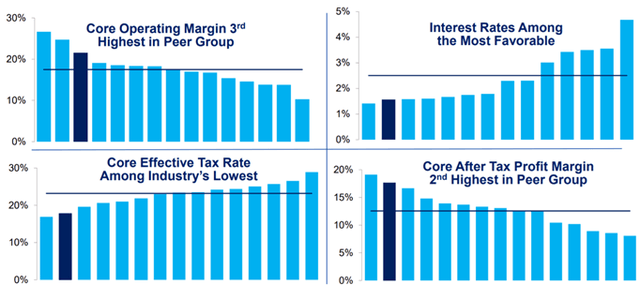

Upfront Income-Generating Covered Call Options Trade:

For investors turned off by the current valuation (the shares appear prudently priced by the market), you may consider boosting your income with a covered call options strategy. Specifically, you might consider selling the January 15th calls for upfront premium income of $0.93, as shown in the table below. This trade puts $93 of extra income in your pocket today (options contracts trade in lots of 100) that you get to keep no matter what. And if their shares rise to $145 over the next 42 days and the shares get called away from you, that's an additional $7.66 of profit in your pocket ($145-$137.34). All in, that's an $8.59 gain in 42 days if the shares get called. And if they don't get called, you still keep the upfront premium income and you're left holding shares of a powerhouse dividend growth stock--Procter & Gamble. To add a little perspective on this trade, if we annualize the $8.59 gain in 42 days, that's a healthy amount of "annual" income.

(image source: TD Ameritrade)

Important to note, P&G likely won't go ex-dividend or announce earnings until just after this options contract expires. That is important because dividends and earnings announcements can add volatility to the share price and risk to your trade. However, in the case of P&G we're comfortable if the shares get called away from us, and we're comfortable to continue holding if they don't.

Risks:

Macro weakness: PG is dependent on the consumer to generate demand for its products. Any macro weakness or recession (due to high unemployment or lack of stimulus benefits) could negatively impact consumer sentiment and reduce product demand.

Consumer preferences: Continued success for the business depends on meeting dynamic consumer needs. For example, the success of new products depends on the company’s ability to correctly anticipate consumer trends and buying habits. Failure to adequately meet changing consumer needs could negatively impact the company.

Increasing competition: The consumer products industry is highly competitive. And PG competes across all its product categories and against a wide variety of global and local competitors. It also faces competition from private label brands.

Conclusion:

Procter & Gamble is an attractive, dividend-paying, blue-chip stock. It’ll never give you the skyrocket returns of some super aggressive growth stock, but it won’t give you the volatility and headaches either. Instead, P&G will give you steady income payments that are competitive with bond market yields.

However, unlike bonds, P&G’s income payments will grow over time, and P&G’s share price will also likely grow over the long-term too. We are not suggesting anyone purchase one stock (such as P&G) in lieu of an entire bond portfolio, but we are suggesting that if you are looking for steady growing income and long-term price appreciation, P&G is an attractive investment to consider for your prudently diversified portfolio. Other attractive dividend-paying blue chips we like are Johnson & Johnson (JNJ) and Microsoft (MSFT), which we recently wrote about in detail here: Forget Bonds. Further, if you have concerns that P&G's share price is currently fully valued, you might consider boosting your income by selling income-generating covered call options.

If you liked this article, please consider following me. You can learn more about who I am and what I offer here.

Disclosure: I am/we are long PG, MSFT, JNJ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

The Link LonkDecember 05, 2020 at 07:13AM

https://seekingalpha.com/article/4393149-forget-bonds-try-p-and-g-and-sell-calls

Forget Bonds: Try P&G, And Sell Calls - Seeking Alpha

https://news.google.com/search?q=forget&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment