Stocks rallied on Wednesday, as Federal Reserve officials made it clear they would keep monetary policy loose despite concerns about inflation, and markets may carry that momentum into Thursday.

The bull market is continuing its charge as investors are “burying their head in the sand” over inflation, said analyst Ipek Ozkardeskaya of Swiss bank Swissquote. She has our call of the day with what to stick to in this market: your favorite growth stocks.

Ozkardeskaya said that Fed Chair Jerome Powell, in his second day of Congressional testimony, talked about some elevated prices, like those caused by the global chip shortage, but shied away from ballooning asset prices and the recent spike in sovereign yields. And the market cheered it, even as inflation remains a key concern.

“The strong case for a rapid rise in consumer prices didn’t disappear overnight because Jerome Powell didn’t want to talk about it,” Ozkardeskaya said. Eventually, there will come a tightening in global financial conditions, she added.

But according to Ozkardeskaya, there is no reason for investors to halt equity purchases, as the Fed continues to flood the market with liquidity.

So what should investors buy? Some advise “value” stocks, which have lower price-to-earnings ratios and may be considered undervalued. Value stock prices are largely driven by earnings growth, so they may perform better than “growth” stocks when conditions tighten.

However, the average price-to-earnings ratio is well ahead of itself, Ozkardeskaya said, meaning there aren’t really any value stocks left.

“You won’t tell me that any stock out there is undervalued right now,” Ozkardeskaya said. “And, looking at the governments’ and central banks’ determination to push more cash in the system, it’s maybe just better to go with your regular, most loved growth stocks and just forget about what’s next.”

Ozkardeskaya also cited UBS research pointing to growth stocks marginally outperforming value stocks in times of liquidity tightening.

If there is a will, there is a way, the Swissquote analyst said. Powell made it clear that he is ready to deal with rising inflation and will keep financing conditions loose.

The buzz

The GameStop GME, +63.55% craze is back. Shares in the videogames retailer rose more than 100% on Wednesday, and is up more than 20% in early Thursday trading. Wednesday trading was twice halted for volatility and Reddit suffered an outage as online personalities and investors alike weighed in on the renewed frenzy.

Other favorites of the Reddit group WallStreetBets, which drove a 2000% spike in GameStop stock in January, are moving higher today, with telecom Nokia NOKIA, +4.63% jumping in European trading and shares in AMC AMC, +0.22%, a movie-theater chain, lifting modestly after surging in the premarket.

There is a lot on the U.S. economic front. 730,000 Americans filed for jobless claims last week, far fewer than the 845,000 that was expected and a sharp decline from 861,000 in the week prior. Continuing jobless claims came in at 4.419 million, fewer than expected and a decline of around 100,000 from the week prior.

The second revision of U.S. gross domestic product growth in the fourth quarter of 2020 came in at 4.1%, slightly ahead of the 4% expected and in the first revision. Durable goods—products meant to last at least three years—rose 3.4% in January, the biggest increase in six months. Later, the presidents of the New York and Atlanta Feds will speak, as will Fed Vice Chair Richard Quarles.

Treasury Secretary Janet Yellen said vaccinations are the strongest stimulus that countries can provide to the world economy in a letter to the Group of 20 countries.

Don’t expect bitcoin BTCUSD, +2.19% to be one of the cryptocurrencies that Mastercard MA, -2.72% plans to start allowing on its network. An executive at the payments services giant said bitcoin “doesn’t behave like a payment instrument” and is “too volatile.”

Chiefs at Goldman Sachs GS, -0.03%, Alphabet GOOGL, -2.77%, Intel INTC, -3.54%, and BlackRock BLK, -1.70% were among more than 160 CEOs that have backed President Joe Biden’s $1.9 trillion stimulus plan.

There are now more millionaires living in London than in New York. Research from property consultant Knight Frank also detailed how London has more homes considered “prime” — worth £2 million ($2.8 million) or more — than any other city.

The markets

Markets are trading lower SPX, -1.90% COMP, -2.66% after rallying late in the day on Wednesday, with the Dow DJIA, -1.29% down slightly. European stocks UKX, -0.11% DAX, -0.69% PX1, -0.24% are largely playing catch-up with yesterday’s performance on Wall Street, and Asian stocks NIK, +1.67% HSI, +1.20% SHCOMP, +0.59% surged.

The chart

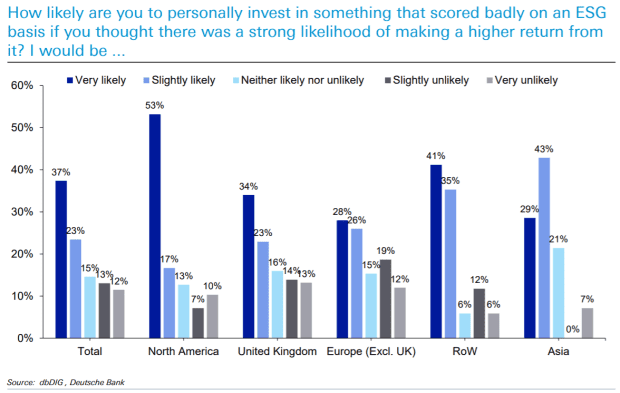

Especially in the U.S., financial considerations still seem to dominate personal investment decisions, shown in this chart from Deutsche Bank DB, +3.50% researchers led by Jim Reid. Their research on environmental, social and governance, or ESG, investing sentiment drew on a survey of 460 global market participants.

The tweet

And be sure to read the live blog recap of Powell’s latest semiannual Congressional testimony.

Random reads

This rescued Australian sheep was freed from wool weighing 78 pounds.

The Mars rover’s giant parachute carried a secret message from a puzzle-loving systems engineer.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

February 26, 2021 at 12:57AM

https://www.marketwatch.com/story/stick-to-your-favorite-growth-stocks-and-just-forget-about-whats-next-with-inflation-says-this-analyst-11614255569

Why you should ‘just forget about what’s next’ and stick with your favorite growth stocks, says this analyst - MarketWatch

https://news.google.com/search?q=forget&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment